KX Fixed Income Bond Screener for ICE® Data Accelerator Overview

Introduction

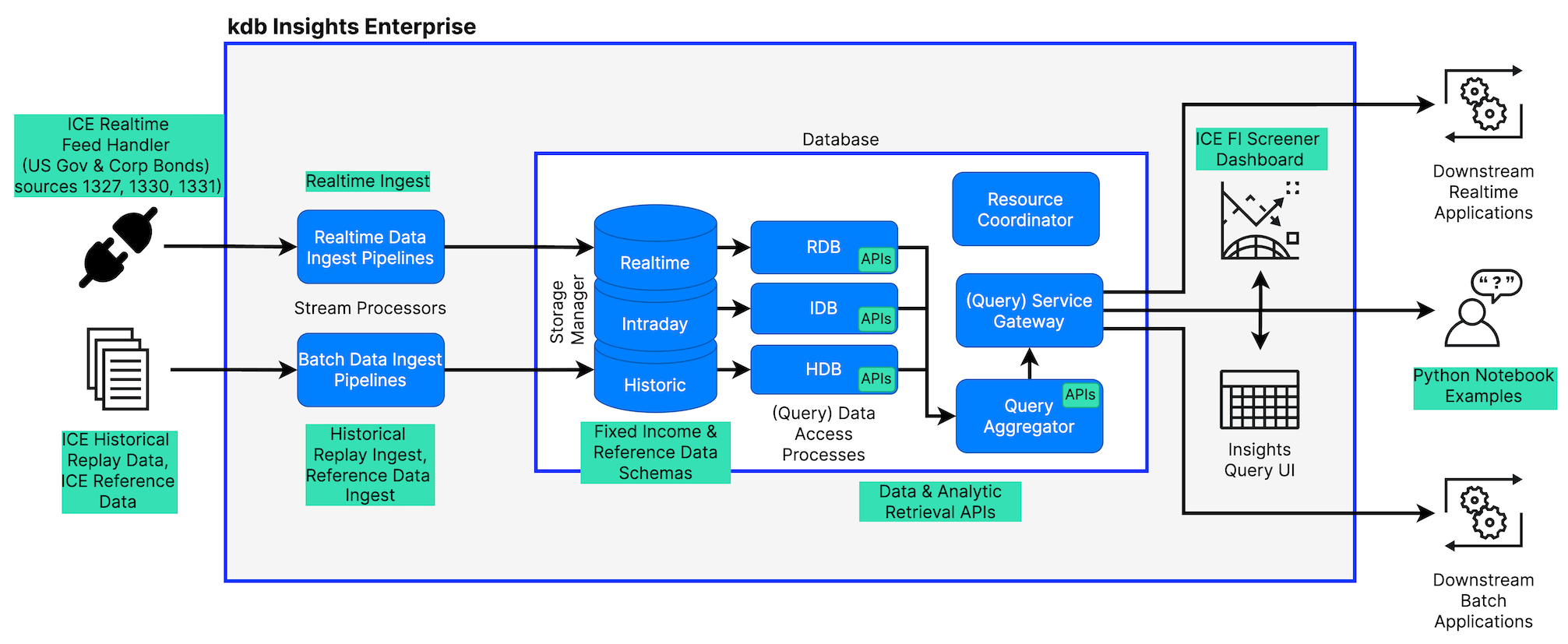

The KX Fixed Income Bond Screener Accelerator ingests realtime, historic, and reference data from ICE® (The Intercontinental Exchange, Inc.®) Fixed Income and Data Services and persists them in kdb Insights Enterprise. Tick-level data can be streamed directly into custom Realtime streaming analytic pipelines, queried using SQL, or analyzed using enhanced Accelerator APIs via Python or any downstream application using REST.

The entire Accelerator can be configured and launched on an existing kdb IE installation in minutes. Quants, business users, and developers can get instant access to high quality ICE data, paired with the power and performance of kdb Insights Enterprise, all without a lengthy implementation project.

kdb Insights Enterprise with KX Fixed Income Bond Screener Accelerator can power use cases such as:

- Portfolio construction – Narrow down on bonds to incorporate into a portfolio. Simple filters are demonstrated in the Accelerator, but the approach can be used to build out more complex analyses incorporating a full range of aggregated and tick level data.

- Backtesting – Faster historical data ingest, enabling quicker algorithm development iteration

Accelerator architecture

The KX Accelerator delivers a scalable, performant architecture including:

- The ICE Realtime Feed Handler

- A pipeline for realtime Quote data ingest

icerealtimefi - A pipeline for replay (historical) Quote data ingest

icehistoricreplayfixedincome - A pipeline COREREF and CROSSREF data ingest

icecorereferenceandicecrossreference - A pipeline for APEX GSM data (ratings and sector information)

iceratings - Schemas for

QuoteandInstrumentdata for the above - Analytic and query APIs via the FSI Library

- Two example Insights Views that combine realtime, historic, and reference data

- An overview screen

- A drilldown screen

- Example Jupyter notebooks, demonstrating Python and REST API access

Further detail

For more information, refer to the following documentation:

- Ingestion details and setup guidelines for real time data

- Fixed Income Data pipeline information and documentation

- Historic Data information on historic data

About ICE®

ICE is a Fortune 500 company that designs, builds, and operates digital networks that combine data, technology, and expertise to connect people to opportunity. They operate exchanges, including the New York Stock Exchange, clearing houses, and mortgage technology that help people invest, raise capital and manage risk across asset classes. By aligning global price discovery data, comprehensive reference, alternative data, events data (corporate actions), analytics and benchmark solutions with proprietary fixed income & OTC capabilities, ICE is uniquely positioned to support the investment community. In addition to continuous investments in technology, what sets ICE apart is the human capital investment of professionals to monitor both liquid and illiquid markets.