Trade

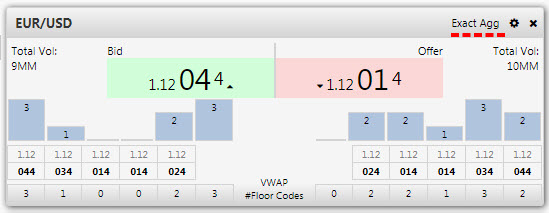

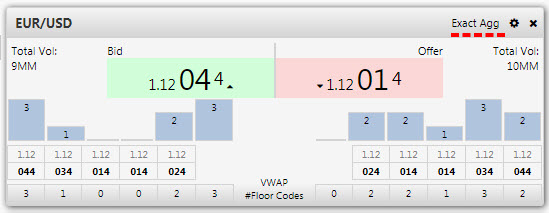

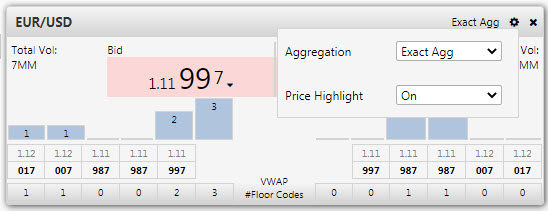

The Trade component displays the book depth for a specific asset symbol.

This includes:

- a graphical/vertical bar chart view that shows market data and calculated statistics

- an option to highlight price tick changes

Set up

1 Assign a Data Connection configured for streaming. Use the html5eval connection as a sample if available.

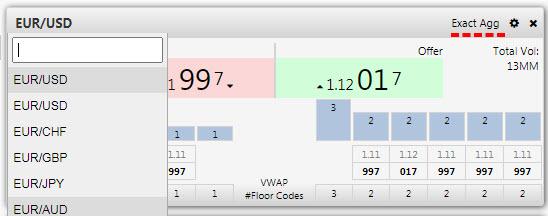

2 Assign list of asset Symbols for the trade panel dropdown.

Sample Query

([]

sym:`$("EUR/USD";"EUR/CHF";"EUR/GBP");

pipsize:(0.0001 0.0001 0.0001)

)3 Setup Panels options.

Sample JSON

[{"aggregation":"Exact","highlight":"On","id":1,"order":0,"pipSize":0.0001,"sym":"EUR/USD"}]

Basics

- Data Connection

- Connection for Trading Panel Subscriptions. See Overview for more details.

- Symbols

- A data source of asset symbols,

symandpipsize; The list of asset symbols are available in the Trade panel dropdown.

| column | type | description |

|---|---|---|

| sym | symbol | asset symbol. |

| pipsize | float | determines the pre, major and minor part of the price quote. |

Sample Query

([]

sym:`$("EUR/USD";"EUR/CHF";"EUR/GBP");

pipsize:(0.0001 0.0001 0.0001)

)- Panels

- Stores user settings as JSON in a view state parameter.

Sample JSON

[{"aggregation":"Exact","highlight":"On","id":1,"order":0,"pipSize":0.0001,"sym":"EUR/USD"},

{"aggregation":"Exact","highlight":"On","id":2,"order":0,"pipSize":0.0001,"sym":"EUR/CHF"},

{"aggregation":"Exact","highlight":"On","id":3,"order":0,"pipSize":0.0001,"sym":"EUR/GBP"}

]| parameter | setting |

|---|---|

| aggregation | 'Exact', 'One Level' or 'Two Level' |

| highlight | 'On' or 'Off' for color highlight |

| id | numeric reference |

| order | listing order for the panels starting from '0' for top left, then across. |

| pipsize | Corresponds to pipsize from Symbols data source; determines the pre, major and minor part of the price quote. |

| sym | Corresponds to sym from Symbol data source. |

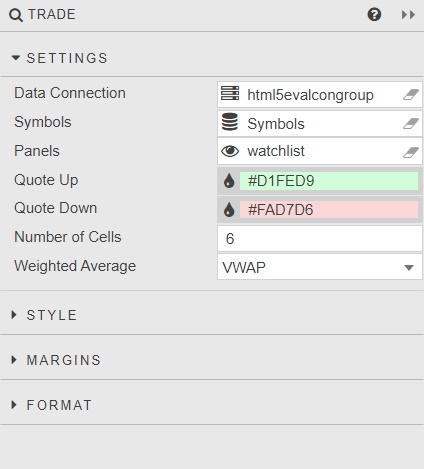

- Quote Up

- Quote Down

- Define highlight color for price rise and price drop

- Number of Cells

- The number of cells/bars displayed on the bid and ask side of the book

- Weighted Average

- Displays either the VWAP (Volume Weighted Average Price) or TWAP (Time Weighted Average Price)

Configure

Step 1. Add a trade panel to the workspace

Step 2. Select symbol from the dropdown

Step 3. Define price aggregation level and use of highlight

Aggregation

| setting | description |

|---|---|

| Exact | Default; lowest pip granularity. Each price level/vertical bar represents the next pip |

| One-Level | Aggregates pips into sets of 10. For example, if best bid is 1.38497 - the price level will be reflected as 1.38490 and all available prices between 1.38490 and 1.38497 will aggregate at the 1.38490 level. The second bid level would be at 1.38480, which aggregates all available prices between 1.38480 and 1.38489. Correspondingly, if the best ask or offer is at 1.38498, then all prices at 1.38498, 1.38499 and 138500 aggregate at the offer level of 1.38500 with the next offer level at 1.38510 aggregating prices between 1.38501 and 1.38510. |

| Two-level | Aggregate pips into sets of 100. A best bid of 1.38497 would aggregate into the 1.38400 level, including all prices between 1.38400 and 1.38497. A best offer at 1.38498 would aggregate 1.38498 to 1.38500 at 1.38500. The next offer of 1.38600 includes all offer prices between 1.38501 and 1.38600. |

Style

Style for common settings

- Bar Color

- Define background color for Graph bars

- Bar Text Color

- Define font color for Graph bars

- Bar Font Size

- Define font size for Graph bars

- Default Text Color

- Define font color for price table

- Default Font Size

- Define font size for price table

- Minor Price Font Size

- Define font size for minor Price font in the quote box

- Major Price Font

- Define font size for major Price font in the quote box

- Pre-Major Price Font Size

- Define font size for pre major Price font in the quote box

Number of cells :The maximum number of trading panel cells. For infinte number of panels, set the property to 0

Highlight Change Duration :The length of time for the highlight (set in milliseconds)

Trade Panel API

Subscriptions

Each trade panel requires a subscription to a streaming analytic. The analytic returns a detailed book depth for a specific asset symbol

Overview The trading panel can subscribe to one of the following streaming analytics:

- book

- book1Agg

- book2Agg

Analytic Parameters

| type | description |

|---|---|

| list | list of subscribing syms |

Analytic Type

- Streaming

Analytics Description

The following are descriptions of each of required streaming analytics:

| analytics | description |

|---|---|

| book (Exact) | lowest pip granularity and default option. Each price level/vertical bar represents the next pip |

| book1Agg (One-Level) | aggregates prices into sets of 10 pips. For example, if the best bid is 1.38497, the price level will be reflected as 1.38490 and all prices between 1.38490-1.38497 will be aggregated into the same level. The second best bid would be 1.38480 and represent prices from 1.38480 - 1.38489. Similarly, if the best offer was 1.38498, prices from 1.38498 - 1.38500 would aggregate to 1.38500. The second best offer level would be 1.38510. |

| book2Agg(Two-Level) | aggregates prices into sets of 100 pips. For example, if the best bid is 1.38497, the price level will be reflected as 1.38400 and all prices between 1.38400-1.38497 will be aggregated into the same level. The second best bid would be 1.38300 and represent prices from 1.38300 - 1.38399. Similarly, if the best offer was 1.38498, prices from 1.38498 - 1.38500 would aggregate to 1.38500. The second best offer level would be 1.38600. |

Subscription key

For each of the trading panel subscriptions, it's keys are defined as follows: [aggregration Type][sym][panel Id]

- aggregration Type : type of aggregration (book, book1Agg or book2Agg)

- sym : the asset symbol

- panel id : the unique id of the panel

Return Type

| column | type | description |

|---|---|---|

| sym | symbol | Asset symbol |

| MDEntrySize | long | Market Data Entry Size |

| MDEntryPx | float | Market Data Entry Price |

| MDEntryType | byte | Market Data Entry Type.(0 Bid , 1 Offer) |

| FloorCode | int | Floor codes participating at each price level |

| MDVWAP | float | Market Data VWAP (Volume weighted average price) |

| MDTWAP | float | Market Data TWAP (Time weighted average price) |