KX Order Book Building for ICE® Data Accelerator Overview

Introduction

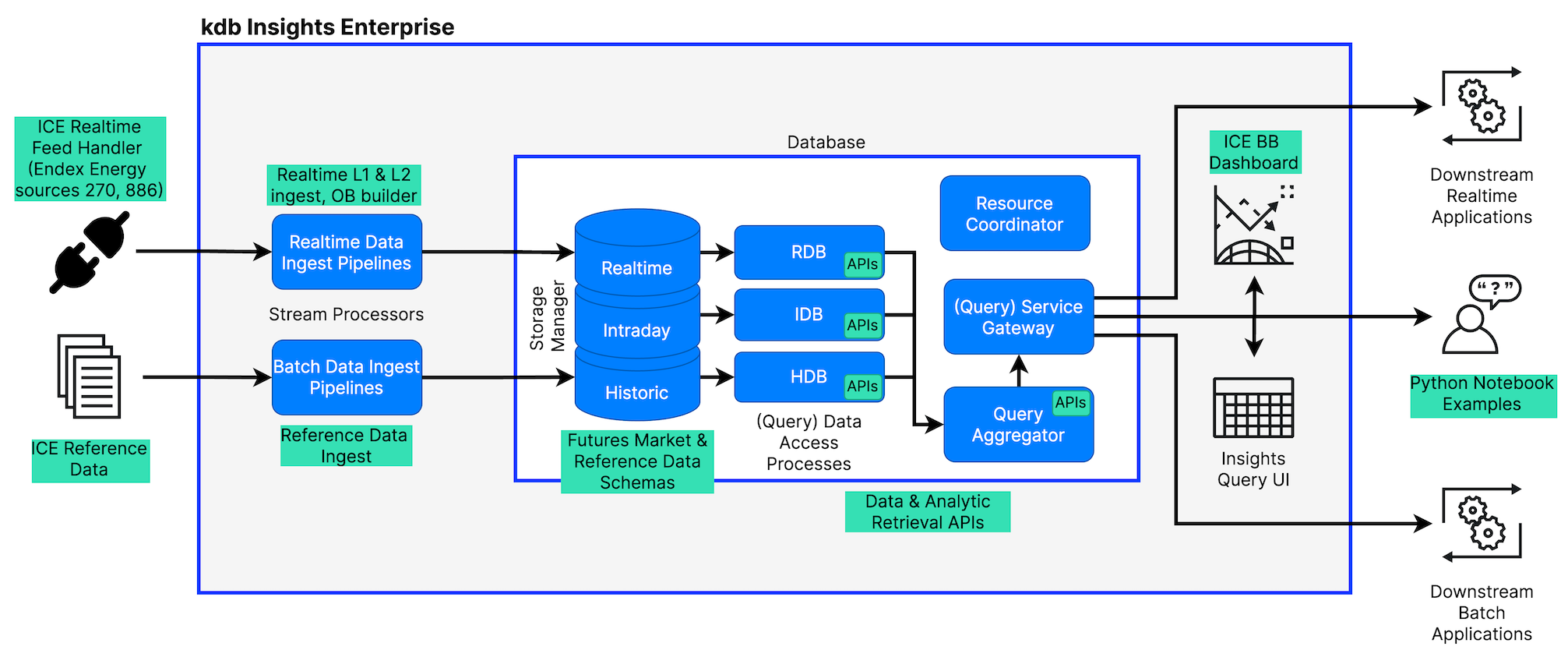

The ICE Order Book Building Accelerator constructs order books from ICE® (The Intercontinental Exchange, Inc.®) Realtime L2 market data and persists them in kdb Insights Enterprise. Order Book data can be streamed directly into custom Realtime streaming analytic pipelines, queried using SQL, or analyzed using enhanced Accelerator APIs via Python or any downstream application using REST.

The entire Accelerator can be configured and launched on an existing kdb IE installation in minutes. Quants, business users, and developers can get instant access to high quality ICE data, paired with the power and performance of kdb Insights Enterprise, all without a lengthy implementation project.

Use cases

kdb Insights Enterprise + KX Order Book Accelerator can power use cases such as:

- Backtesting – Providing faster backtesting runs, which means quicker algo development iteration

- Post-trade analytics and TCA – Gain fine grained access to L2 book snapshots for execution traces and true cost analyzes. Addresses compliance needs and gives better informed order entry strategies.

Architecture and features

The Accelerator delivers a scalable, performant architecture including:

- The ICE Realtime Feed Handler

- Pipelines for L1 Trade and Quote data ingest

icerealtime1-sp - Pipelines for L2 Quote data ingest

icerealtime2-spand orderbook constructionorderbook-sp - Schemas for L1 data (

TradeandQuote), L2 data (L2Quote), and constructed order book data- Snapshot formatting, with arrays of price levels in a single field

OrderBookSnapshots - Depth formatting, with order book levels on individual rows

Depth

- Snapshot formatting, with arrays of price levels in a single field

- Query and analytic APIs via the FSI Library

- An example Insight View for displaying streaming data

- Example Jupyter notebooks, demonstrating Python and REST API access

Further details

- Ingestion details and setup guidelines

- Order Book Data pipeline information and documentation

About ICE

ICE is a Fortune 500 company that designs, builds, and operates digital networks that combine data, technology, and expertise to connect people to opportunity. They operate exchanges, including the New York Stock Exchange, clearing houses, and mortgage technology that help people invest, raise capital and manage risk across asset classes. By aligning global price discovery data, comprehensive reference, alternative data, events data (corporate actions), analytics and benchmark solutions with proprietary fixed income & OTC capabilities, ICE is uniquely positioned to support the investment community. In addition to continuous investments in technology, what sets ICE apart is the human capital investment of professionals to monitor both liquid and illiquid markets.